You may obtain even more of a discount rate if all of the motorists in the residence take the defensive driving program. Excellent student discounts are out there, also.

Associated Products & Discounts Get protection that can assist offer you tranquility of mind when you're on the road. This price cut is readily available to motorists that preserve a B standard or its comparable, or remain in the upper 20% of their class scholastically (cheapest). Age restrictions apply. This insurance coverage supplies as well as spends for covered towing as well as labor costs if your lorry breaks down.

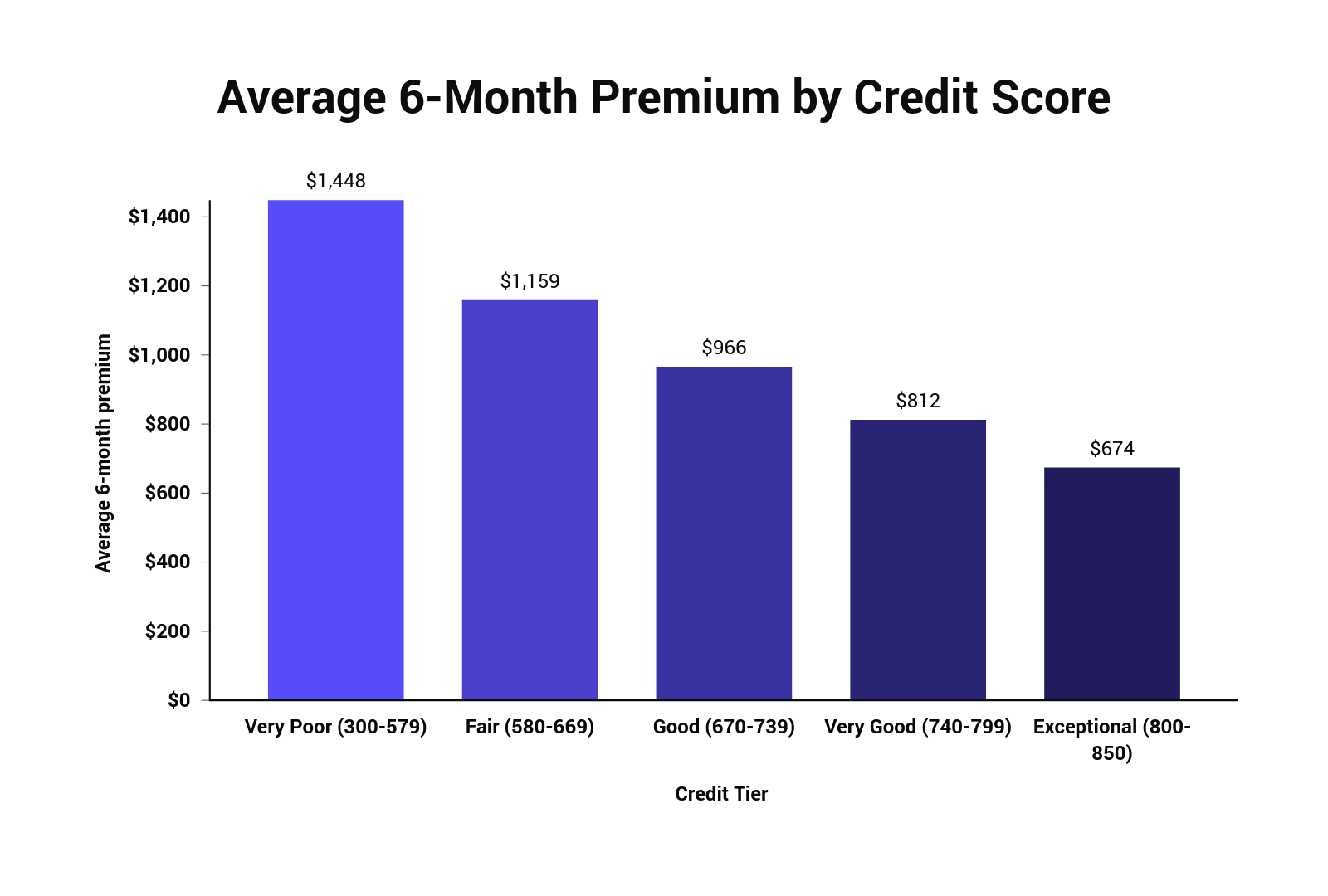

Insurance provider set the price - or premium - for your auto insurance policy utilizing a number of factors, such as your years of driving experience; your mishap as well as offense history; as well as, the location where your automobile is normally garaged or parked - cars. Most individuals purchase insurance with an insurance deductible of state $500 or $1000 in order to save cash.

You may have the ability to get a price cut on your policy if you complete an accepted driver training program, so you must finish one as quickly as feasible. Numerous insurers provide students a price cut for preserving an overall B standard or far better. You may desire to consider postponing owning your own automobile, when possible.

Take into consideration the price of insurance coverage before you make that down settlement.

Last updated: 13 April 2022How to obtain less expensive insurance coverage for 18-year-olds, There are a lot of methods for younger vehicle drivers to keep the price of their car insurance down to a minimum (cheap). It will still be expensive, yet with the appropriate plan, the appropriate insurer, and also the appropriate vehicle, insurance for 18-year-olds can be a lot more economical than you might believe, Dos and do n'ts of obtaining less expensive vehicle insurance policy at 18 Nonetheless sensible you might be on the road, insurance firms will still consider you a risk because of your age.

10 Simple Techniques For The Best Car Insurance For 18-year-olds - The Zebra

The substantial benefit of having a 2nd, much more knowledgeable chauffeur on your plan is that insurers will end that a proportion of the miles driven in the insured automobile will be done by somebody with a recognized track record (cheaper). This can mean you're provided a lower premium. Preferably, pick a named vehicle driver who mores than 25 as this will reduce expenses even more.

If the difference is significant, consider having the mods got rid of. Don't overestimate your gas mileage, The typical driver clocks up between 6,000 as well as 7,000 miles a year. A lot of these motorists use their vehicle to commute to function or to travel to holiday locations, which an 18-year-old is arguably less most likely to do.

As a just recently qualified motorist, you're unlikely to understand the amount of miles you'll cover over a year, however you need to be able to make a rough guess. Try to gauge what you carry out in a typical week as well as increase it for the year. Consider your cars and truck insurance coverage unwanted, When you look for car insurance coverage, you are asked what volunteer excess you agree to take on.

Where can I discover economical vehicle insurance policy for 18-year-olds? The very best, most trusted location to find the most inexpensive vehicle insurance for 18-year-olds gets on a rate contrast website. insure. This allows you see numerous prospective policies on the outcomes page and also fine-tune your needs, such as excess levels, to see what works finest.

For an 18-year-old, the fact that one in 4 motorists aged much less than 25 will certainly be associated with a crash within 2 years of passing their test is specifically sobering, especially considering that lots of would have obtained their complete licence while still 17. The method you utilize your car might be different, too.

In an accident, these pals get wounded as well. Paying out for a life time of like a completely handicapped individual costs insurers much more the more youthful they are since the treatment is expected to last for longer. What type of driving should 18-year-olds stay clear of? Any type of sort of driving that might bring about an accident or factors on your license.

What Does Adding A Teen To Your Auto Insurance Policy - Incharge Debt ... Mean?

Stay clear of distractions, Some young chauffeurs use their vehicles for entertainment. They are typically gone along with by loud friends, blasting music and a phone buzzing with messages. Driving takes focus, and distractions boost the possibility of not finding a hazard until it is far too late. Don't enable any person to egg you on, Younger guests or good friends in various other cars and trucks may motivate you to take unnecessary dangers. suvs.

Second, although the age of 18 is the factor at which you end up being a lawful grownup, researchers claim our minds do not quit developing up until around the age of 30 *. This may indicate that younger people are liable to react emotionally as opposed to realistically, which is not ideal when driving. The result is that insurance providers presume that there is a greater chance that young individuals will take threats, display or bend to peer pressure.

Are there any kind of choices to cars and truck insurance coverage? While you can not make believe that someone else is the main driver of your cars and truck to benefit from less costly insurance that would certainly be a kind of fraud known as fronting you can be a called vehicle driver on one more individual's cars and truck.

They might require accessibility to a vehicle for a short period of time, such as if they are moving their possessions to university. In this case, short-term car insurance coverage cover might confirm helpful as well as absolutely cheaper than an annual policy. * Teacher Peter Jones on the transformation to adulthood. car insurance.

cheaper cars cheaper car cheap

cheaper cars cheaper car cheap

Having a teenager motorist can get expensive, swiftly. Moms and dads as well as guardians need to take the time to chat to teen drivers regarding the seriousness of driving safely.

com made use of a family members profile of owning a 2019 Honda Accord driven by a 40-year old man purchasing complete insurance coverage. After that they included a 16-year old teen to the plan. This is what they saw happen to the rates: The average household's cars and truck insurance expense rose 152%. A teen child was extra expensive.

The Ultimate Guide To Teen Auto - La Dept Of Insurance

According to the article, the reason behind the boost was due to the fact that "teens crash at a much higher price than older vehicle drivers. Insurance policy companies have to prepare for that anticipated sustained price of guaranteeing the motorist.

Normally, automobile insurance firms will not communicate what discounts they supply to teen chauffeurs unless you ask. Do your research and understand what is readily available to you. credit. To get you started, below are several of the most effective discount rates for teenager vehicle drivers that will help you obtain automobile insurance coverage that you can manage.

Not all of these discounts can be utilized at the very same time or combined together - cheapest auto insurance. So see to it you completely understand what is as well as isn't accepted by your insurance policy service provider. Excellent Pupil Discount: Basically, if your teen shows excellent qualities and duty in school, they obtain a break on the rate of automobile insurance.

cheap car insurance cars auto insurance low cost

cheap car insurance cars auto insurance low cost

affordable auto insurance low cost laws laws

Pupil Away Discount: If your teenager is away for college and not driving, ask your carrier regarding an "away" discount. This can save you around 5%-10%. Raise Your Deductible: This merely indicates you raise the amount that you are accountable for covering in the occasion of a mishap and is a very easy means to lower automobile insurance costs - auto.

Be sure to ask your representative about the time periods and also when this ends up being offered to the motorist. Good driving routines are vital to maintaining insurance policy premiums low and also affordable - business insurance.

982 individuals died in website traffic crashes on our state roadways in 2017. That corresponds to one fatality every nine hrs.

Top Guidelines Of How To Get The Best Cheap Car Insurance For An 18-year-old

For several teens, the expense of acquiring cars and truck insurance coverage on their very read more own may be greater than their summer tasks can handle. That's why several parents place young adults on the household insurance plan, where the expenditure is much less than if a teen got his or her own insurance plan. Eventually, however, young adults end up being grownups and also their insurance risk level declines.

You might be wondering; How long can a youngster remain on their parents' car insurance coverage? The truth is, moms and dads can maintain children on the family members auto insurance policy for as long as they want, however it may not always make monetary sense. In this regard, there are crucial aspects to consider - insurance companies.

Recognizing the appropriate age to do it is the difficulty - cheap insurance. Different auto insurance policy prices for teen women and boys Teenagers on a family's cars and truck insurance coverage will certainly be rated greater and also in different ways, based upon their sex, than older grownups. "If two parents have boy-and-girl fraternal twins, each obtaining their chauffeur's certificate at the same time, the lady will initially receive a better price than the child, based on statistical information showing a reduced risk of accidents including teenage women," states Kevin Lynch, assistant teacher of insurance coverage at The American University of Financial Providers in Bryn Mawr, Pennsylvania.

Boys may not have common grown-up rates up until they get to age 25 if they have a tidy driving document. No matter of gender, showing your teens secure driving is of the utmost importance, both for insurance policy prices and also their safety and security. Here are some teen driving safety suggestions to help you get begun.

" My kid relocated to Texas after university, where cars and truck insurance is a lot less expensive than it remains in New york city," says Hartwig - insured car. "He worked and also could manage his very own insurance policy currently. insured car." Reevaluate your auto insurance plan after graduation Many parents generally choose to preserve teenagers on the family's vehicle insurance coverage up until they finish from college, thinking they locate employment and also live away from residence.

Yet if the youngster can afford paying for his/her own vehicle insurance policy, this is the time for the family to take a seat and also chat about it. Ask an insurance representative Hartwig even more suggests consisting of an insurance coverage agent in the conversation. "An agent has the risk and also insurance coverage knowledge to aid with a talk on the different kinds of insurance policy coverages that exist out there and the significance in purchasing for insurance, comparing as well as contrasting the terms, problems as well as expenses of different plans," he states.

All about How To Buy Auto Insurance For 18 Year Olds

When it involves teen drivers and also auto insurance policy, points get complex-- and costly-- promptly. A moms and dad including a male teenager to a plan can expect vehicle insurance policy rate to swell to greater than $3,000 for full insurance coverage (cheap car insurance). It's also higher if the teen has his very own policy.